dupage county sales tax vs cook county

Median Annual Property Tax Payment. The average bill in DuPage County is higher than nearly 98 percent followed by Kane County and McHenry County both 96 percent Cook.

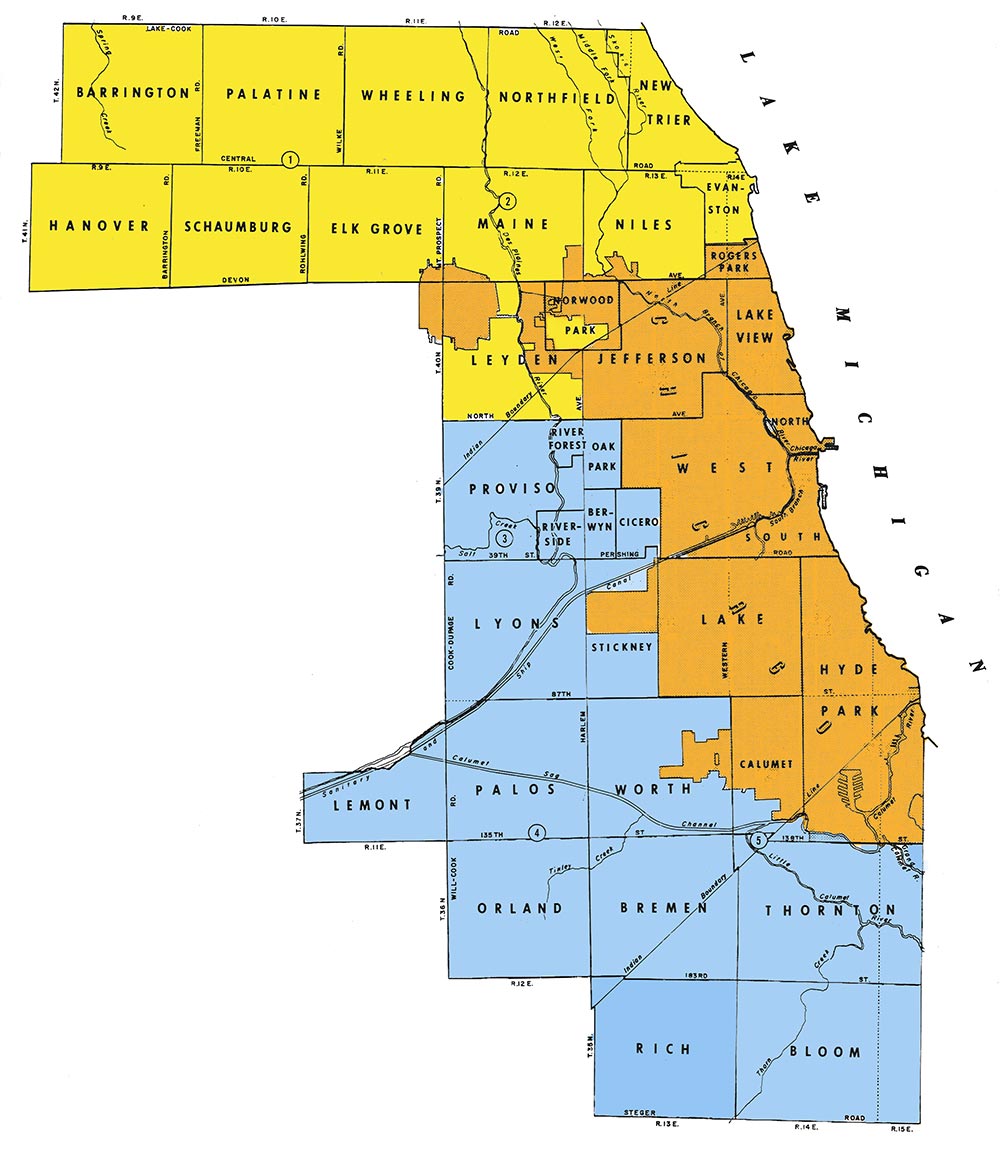

How To Determine Your Lake County Township Kensington Research

To figure the correct tax due add 125 0125 to.

. Registered tax buyer check-in begins at 800 am. Has impacted many state nexus laws and sales tax collection requirements. In DuPage County its 675 percent and in.

Cook County Illinois Png Images Pngwing. 15 Boulevard Poissonnière 75002 PARIS. While many counties do levy a countywide sales tax Dupage County does not.

25 DuPage County IL. The current total local sales tax rate in dupage county il is 7000. 0610 cents per kilowatt-hour.

I go to DuPage for county free tax gas and liquor. Latitude 415718N and longitude 875624W. This is the total of state and county sales tax rates.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Population percent change - April 1 2010 estimates base to. The Tax Sale will start promptly at 900 am and will run until 430-500 pm Using an automated tax sale system we anticipate the sale running for one full day.

Cook county sheriff vs chicago police. Crawford county 927 tax assessor. Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7.

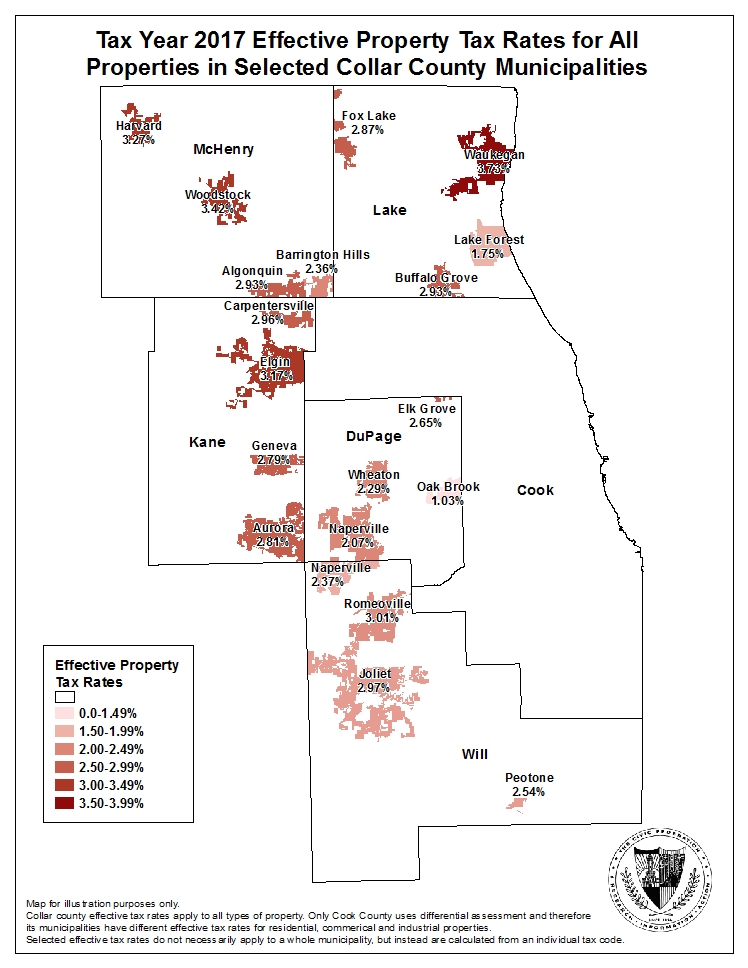

DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes. If you sell an item from a location in Cook DuPage Kane Lake McHenry or Will County and your customers address on Form ST-556 Section 1 is within the corporate limits of the city of Chicago your customer owes an additional 125 home rule use sales tax. By Annie Hunt Feb 8 2016.

Cook has more taxes than DuPage. Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago. Illinois relies more than Indiana on individual and business income taxes.

What about your take-home pay. The Dupage County sales tax rate is. Illinois IL state sales tax rate in DuPage are the lowest in the of.

The satellite coordinates of Bensenville are. Illinois taxes individual income at a rate of 495 and business income at 7. Payments must be received at the local bank prior to close of their business day to avoid a late payment.

Average Effective Property Tax Rate. DuPage County collects on average 171 of a propertys assessed fair market value as property tax. Wishing you the best.

The Illinois state sales tax rate is currently. 1337 rows Illinois has state sales tax of 625 and allows local governments to collect a local. 24 Champaign County IL.

The part of Naperville in DuPage County had a 2005 tax rate of 57984. Chicago Home Rule Use Tax. Look into taxes whether property taxes salestax county tax etc.

Dupage County Has No County-Level Sales Tax. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. County Farm Road Wheaton Illinois 60187.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. These rates were based on a tax hike that dates to 1985.

In DuPage County property tax rates vary widely between suburbs with 2005 taxes rates ranging from 82058 for Glendale Heights down to 27896 for Oak Brook. Dupage county sales tax vs cook county. Metro-East Park and Recreation District Tax The Metro-East Park and Recreation District tax of 010 is imposed on sales of general merchandise within the districts boundaries.

Dupage county vs cook countyal arabi sports club qatar. Cook County IL DuPage County IL Population estimates July 1 2019 V2019 5180493. Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025.

Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were. DuPage County Administration Building Auditorium 421 N. The sales tax in Chicago is 875 percent.

The base sales tax rate in DuPage County is 7 7 cents per 100. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. The 2018 United States Supreme Court decision in South Dakota v.

900 St Carlyle IL rate50 cents to a County where the tax Deed Department at 312-603-5356. There are 902 places city towns hamlets within a radius of 100 kilometers 62 miles from the. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900. I am in Dupage and my property taxes have ranged between 15 and 25 depending on. The DuPage County Clerk has a list of 2005 taxes rates by community.

I live in Cook for accessibility to Chicago- expressways and train stations. The Illinois sales tax of 625 applies countywide. In Cook County outside of Chicago its 775 percent.

Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. The counties with the Top 25 highest average rates along with their median home values and median annual property tax payments are listed below the map. Dupage county sales tax vs cook county.

To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925. Cumberland county 1285 tax assessor. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

Tax allocation breakdown of the 7 percent sales tax rate on General Merchandise and titled or.

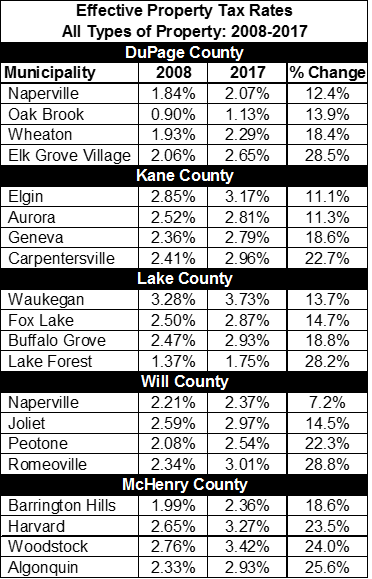

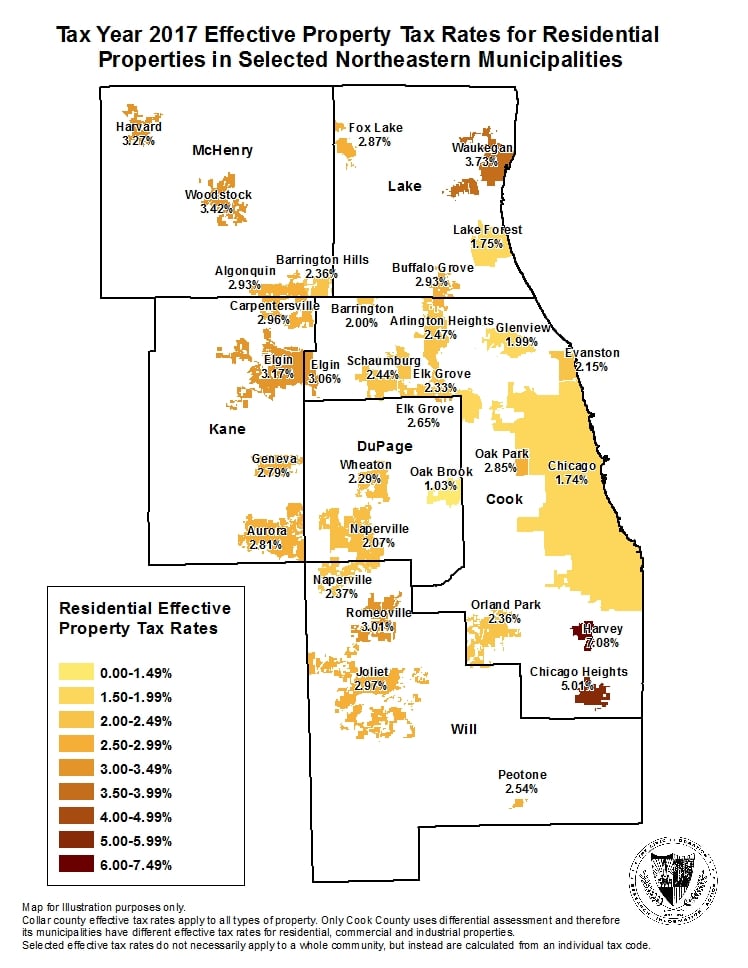

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

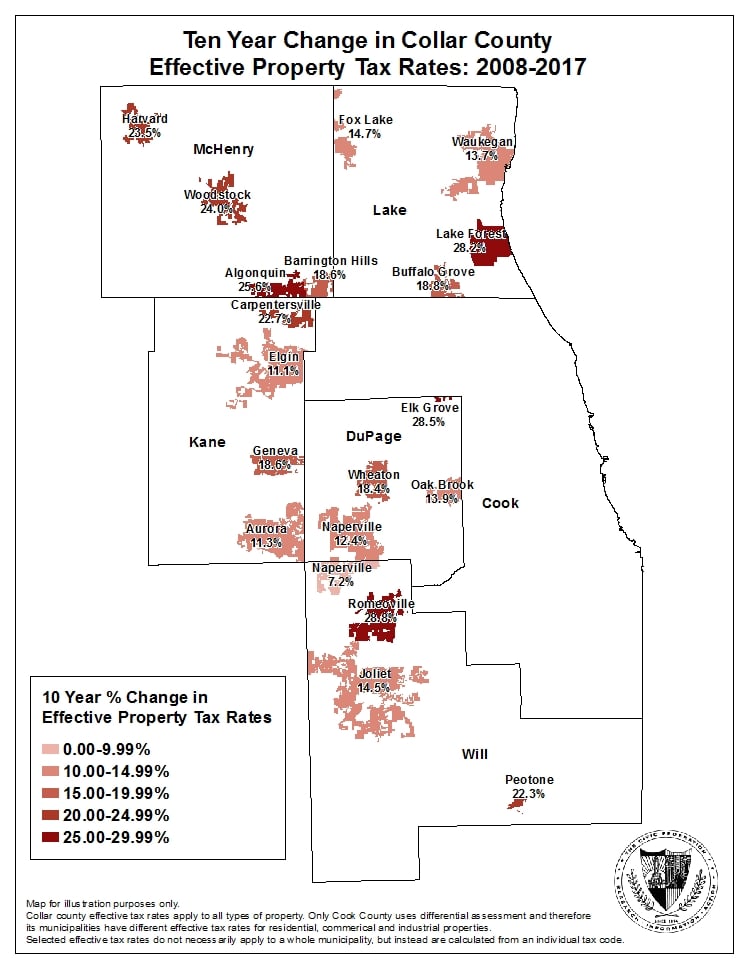

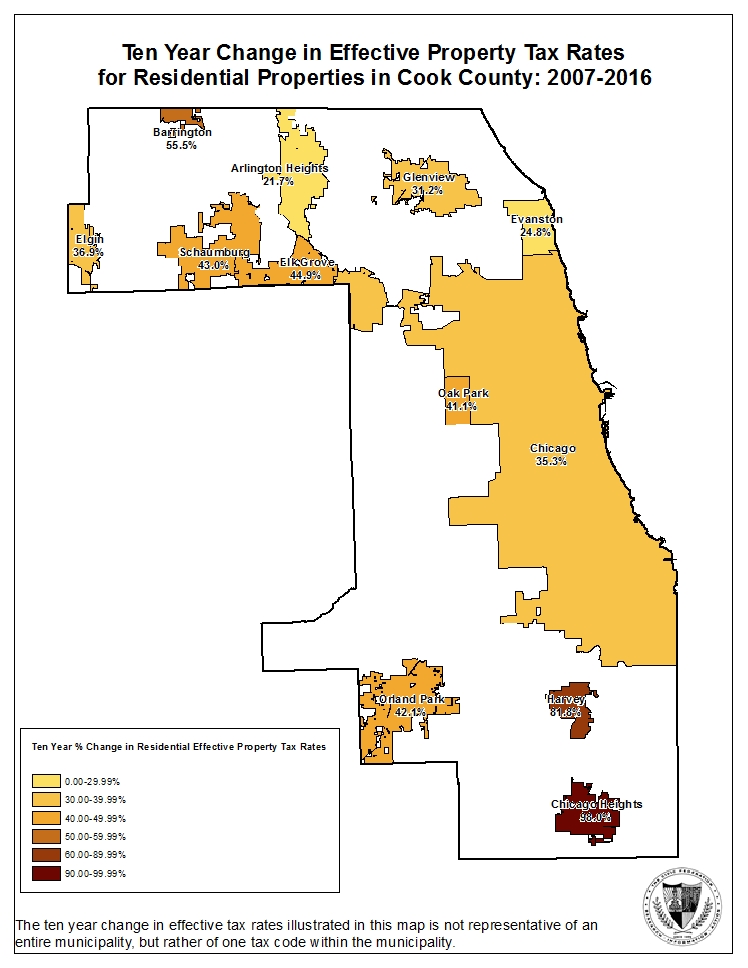

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Property Tax Resources In Chicago Il Sarnoff Baccash

Illinois Sales Tax Rates By City County 2022

Property Tax Resources In Chicago Il Sarnoff Baccash

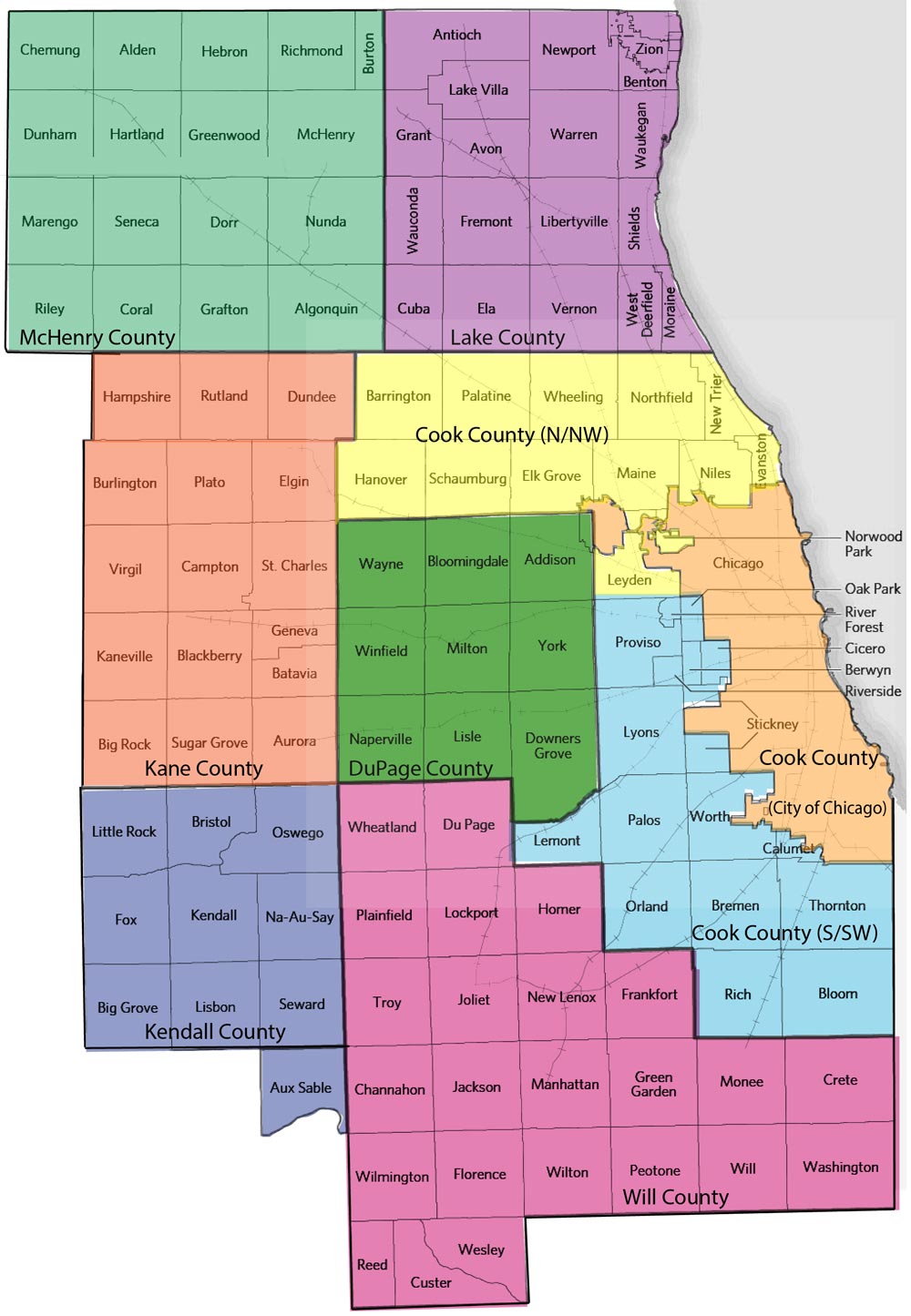

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

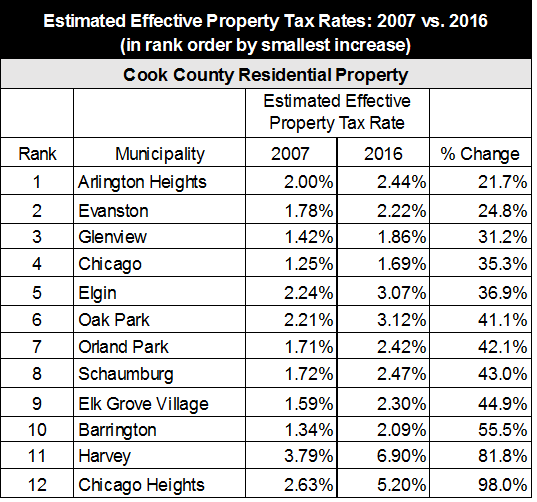

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

2022 Best Places To Buy A House In Dupage County Il Niche

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

30 Counties Including Dupage Dekalb On Idph Covid 19 Warning List Kane County Connects

Kane Joins Dupage As West Suburban Region In State S New Covid 19 Mitigation Plan Kane County Connects